On Saturday, February 1, 2020, TOC successful hosted an introductory Tax Planning webinar! This event was aimed at helping horse owners gain a working knowledge on key tax considerations faced by equine industry participants, including:

– How to structure operations and related accounting and reporting items,

– Tax incentives available to horse and farm owners,

– Hobby loss and passive activity rules, and

– Multistate tax considerations.

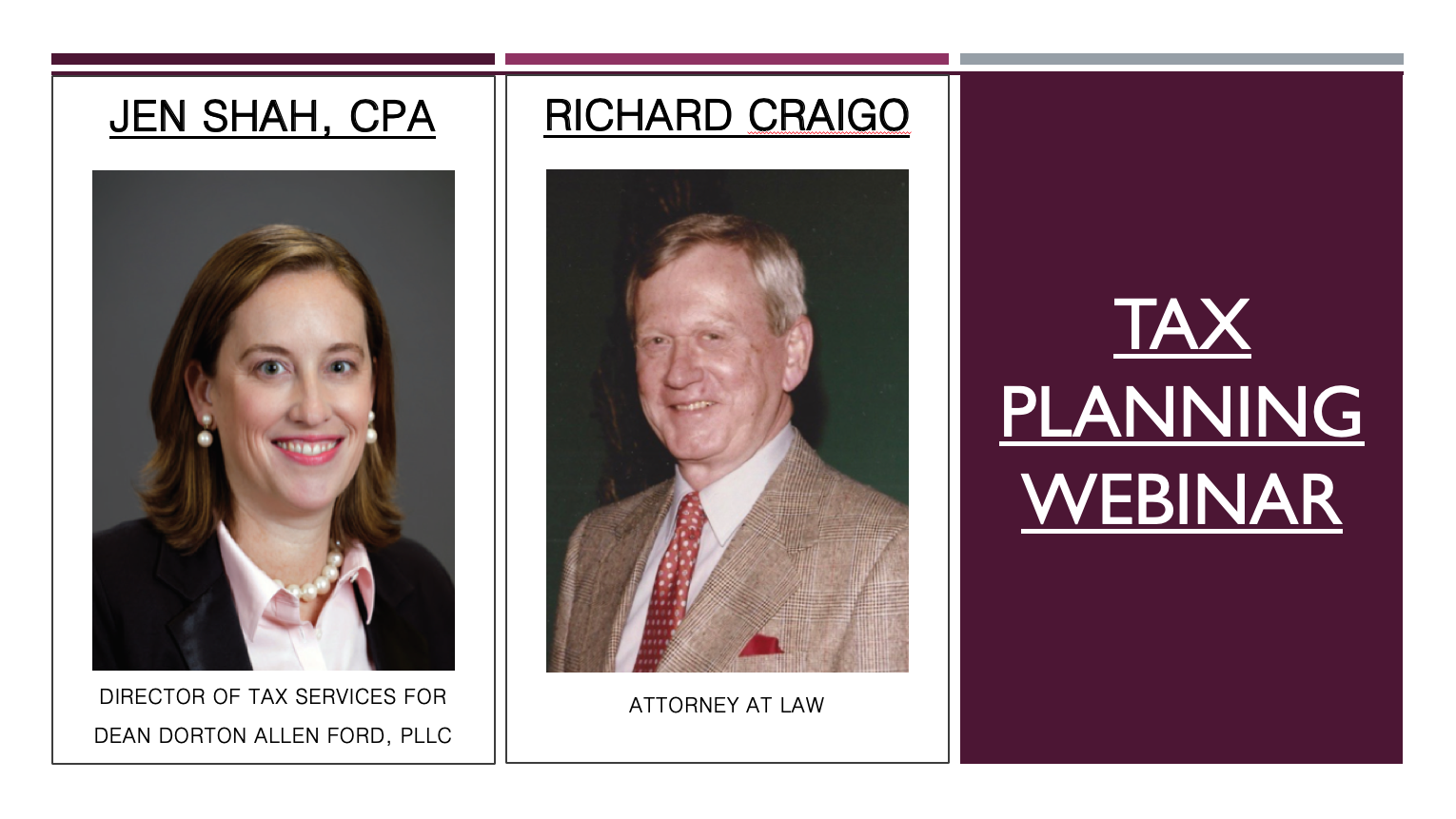

Participants included:

Shah is the Director of Tax Services for Dean Dorton Allen Ford, PLLC, where she advises business and individual clients on tax and general business consulting matters. She leads the firm’s equine practice, working extensively with participants in the horse industry. Shaw can be reached at (859) 425-7651 or at jshah@deandorton.com. You can also visit their website at www.deandorton.com.

Craigo is a Certified Taxation Specialist and practitioner in Equine Law. He has represented over 200 owners, breeders, trainers, veterinarians and bloodstock agents worldwide in business transactions including national and international purchases, sales, and syndicates; administrative law practice; and income and sales tax matters, including representation of horse owners in over 150 “hobby loss” and “passive loss” disputes with the Internal Revenue Service and state taxing authorities. Craigo can be reached at (424) 248-0936 or at equine@craigolaw.com.

Tax Webinar Recording & Handouts:

Click here to see a list of TOC’s future events!